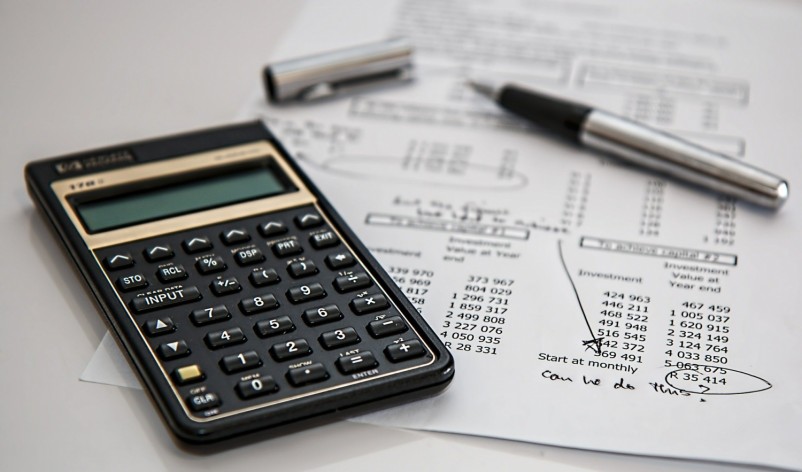

When you have a small business and are a sole proprietor, in a partnership, or work as an independent contractor, you are responsible to pay the taxes for your business on your personal tax form. You will need to pay estimated tax payments to the IRS quarterly. A business tax calculator can easily help you determine how much you need to pay.

Keep Good Records

If you keep your books up to date, it will be much easier to calculate your business taxes. Because you are paying quarterly, you will only need to know the figures for the quarter you are calculating. You will need to know the following:

- Income

- Deductions

- Social Security and Medicare (15.3%)

- Taxes already paid per quarter

- Exemptions

- Credits

- Meals and Entertainment.

It needs to be remembered that the tax tools you use will generally only provide you with an estimate of your quarterly taxes. In order to know the exact amount, you will need to complete the tax forms for each quarter and then the totals for the year-end taxes.

Calculating Your Business Taxes

One way that you can calculate your quarterly estimated tax payments is to take a portion of your year's income and figure out how much it would come to for the year. Do the same thing with your deductions. Then use the figures for the previous year for things such as food and entertainment and expenses. Once you have the total amount, you simply divide it by four to arrive at your quarterly payment amount.

A simpler way, if you were in business for the previous year, would be to take those tax figures and use them. If your income so far this year is larger, then make adjustments accordingly.

At the end of the year, when you fill out your personal tax form, you will be able to get a corrected amount. It will include all previous tax payments for the year, letting you make a final year-end payment that is adjusted according to your actual profit and expenses, etc.

Who Must Pay the Estimated Business Taxes?

The IRS requires that you need to make quarterly tax payments if you are an individual, a sole proprietor, in a partnership, or are an S corporation shareholder and will owe more than $1,000 in taxes. A corporation must make estimated tax payments if more than $500 is owed in taxes.

Making Quarterly Payments

The IRS expects your quarterly payments to be paid on time. Each quarter has an end date just like the due date for personal taxes - April 15th. A penalty may be required to be paid if the payments are late. The due dates for each quarter are as follows:

- April 15

- June 15

- Sept. 15

- Jan. 15 (of the following year)

When it comes time to calculate taxes for your small business, you can take advantage of the tax calculator at Taxfyle. The calculator gives you the option to select the type of business you have, enabling you to arrive at the estimated tax payment you need. Our easy to use apps and friendly tax consultants can help you file your taxes on time.

Share on Facebook

Share on Facebook